Article by Colin Packham, courtesy of The Australian.

24.02.2025

The transition to electric vehicles is taking longer than expected despite a series of incentives to bolster demand, and as a result demand for fuel has hit a record high, Ampol chief executive Matt Halliday says.

The sluggish uptake of EVs is a blow to the federal Labor government, which insisted its plan to use tax concessions would drive new orders, and it also provides some headwinds for Ampol’s strategy.

Ampol has in recent years positioned itself for the rise of EVs through a series of acquisitions that expand its retail offering.

The company hopes that it will lure customers with the offer of shopping while simultaneously charging their EVs.

Matt Halliday says demand for EVs is lukewarm and so the company is reaping the benefits of higher demand for petrol.

“We haven’t seen an uptake in EVs that we might have otherwise expected. They are flat year-on-year at about 7 per cent of new car sales. I think that reflects a few things: one, the tough economy, and two, the lack of charging infrastructure, so that means we aren’t seeing that step-up. It all just highlights that the transition is going to take time,” Mr Halliday said.

“It has some challenges with it, and we are seeing that flow through to fuel demand.”

The sluggish demand for EVs leaves Ampol facing a dilemma, as it has committed to installing 300 charging bays. Mr Halliday said the company remained committed to that target, but would not move aggressively to roll out expensive infrastructure when there was insufficient demand.

Mr Halliday, however, said the company has inherent flexibility in how quickly it rolled out the new chargers, as its traditional bowser network provided a “natural hedge”.

Ampol has moved to aggressively expand its retail presence, which it said would protect its earnings from cyclical commodity patterns and future-proof its Australian fuel business, which was in a state of flux.

Recharging an EV can take more than 30 minutes even with fast chargers, and Ampol will need to offer consumers attractive options while they wait.

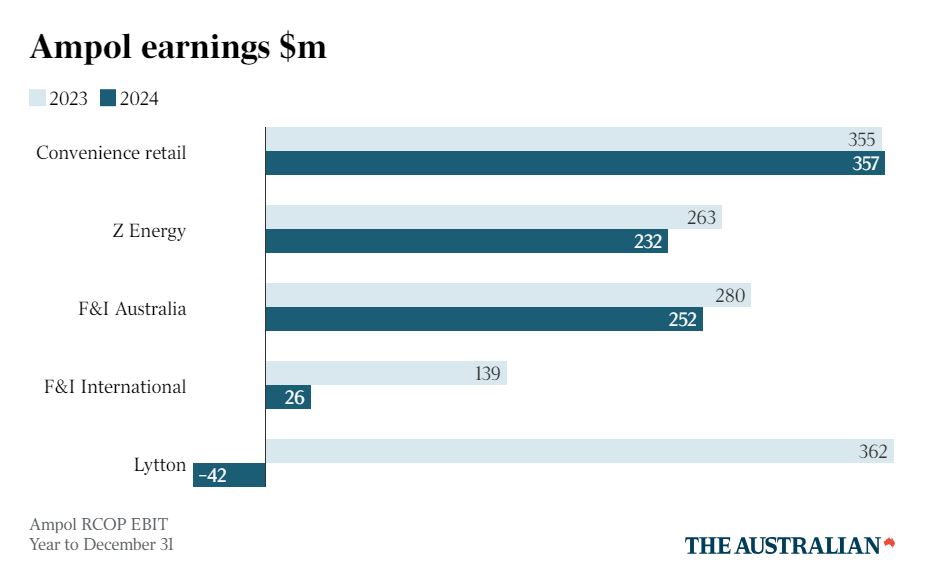

Mr Halliday’s comments came as Ampol reported a 78 per cent drop in annual profit, led by its key oil refining business.

The result will fuel concerns about the capacity of Ampol to bolster its earnings as amid declining refining conditions.

Ampol shares fell 3 per cent to $27.19 on Monday.

The company said statutory profits during 2024 totalled $122.5m, down from $549.1m a year earlier. The result was below market forecasts.

Ampol slashed its final dividend to 5c a share, from $1.20 a year earlier. That takes the total for 2024 to 65c, also sharply down from $2.15 in 2023. In addition, it also paid a special dividend of 60c in 2023.

The decline was fuelled by a more than 100 per cent fall in earnings from its refining business. Ampol said the division recorded an annual loss of $42.3m, having recorded a profit of $362.3m one year earlier.

The company said the loss was driven by a “material deterioration” of the refining market, and it warned conditions remained weak in January.

Ampol has for several years ridden a wave of success from its oil refining business, and the downcast result in the segment will add to concerns about the future of the division.

But Mr Halliday said refining margins had improved in February, indicating an improvement in fundamentals, though analysts cautioned that the market remained volatile.

Ampol’s refining business was also badly affected by a series of planned and unplanned outages, but Mr Halliday said he was confident those issues were now behind the company.

Still, the downbeat performance of refining increases the pressure on Ampol’s strategy to broaden its earnings.

The group has tried to expand beyond its roots, a strategy it looked to accelerate with its 2021 acquisition of New Zealand’s Z Energy for $NZ1.97bn. Ampol hopes that with a broad retail offering, complete with takeaway coffee and restaurants, it will persuade customers to shop or eat while they recharge.